The world is tired of the complicated and inefficient invoicing process. Sometimes it takes weeks for an invoice to be booked properly.

Not to mention the human errors that influence the accuracy of your invoice data, or the ghost invoices that constantly challenge the safety of our current invoice process.

It's time to make a change. But is your company ready for this? In this article you'll find everything about electronic invoices. The what, the how and the why:

- Why is it mandatory to send electronic invoices to the authorities?

- What is an electronic invoice?

- How can I send e-invoices to government authorities?

- What are the benefits of electronic invoices?

- How Vattenfall easily simplified their invoicing process

- Want to send e-invoices yourself?

- More information about electronic invoicing.

- Using an international E-invoicing platform

Why is it mandatory to send electronic invoices to the government?

Every year, millions of invoices are sent to the authorities worldwide. A large part of these invoices are still processed by hand. This costs a lot of time and money. Not to mention the regularly made errors.

In other words: the current invoicing process is not ideal, and surely not flawless. Therefore, the European authorities decided to encourage the use of the much safer - and more efficient - e-invoicing (electronic invoicing).

The European Directive (2014/55 / EU) stated that all contracting authorities should be able to receive and process e-invoices by the end of 2018.

In other words: All suppliers that send invoices to government are now obligated to deliver e-invoices.

Read more: Download our free E-invoicing Compliance Timeline

What is an electronic invoice?

Electronic invoices - or UBL invoices - are XML files that are sent directly from one bookkeeping system to another. It's a structured, digital file in with information such as company name and number. Be aware, however, that an electronic invoice is not a PDF file.

Because invoices are sent from one system to another, it's no longer necessary to process invoices by hand. This way, an e-invoice lands directly in the recipient's accounting software without manual interference.

This creates a lot of efficiency both in the long and short term.

Read more: E-invoice Formats Explained: A Comprehensive Guide to All Types (In-Depth Analysis)

How can I send e-invoices to government authorities?

You can easily send electronic invoices with your own accounting package. Be aware though that you should consider a number of things in advance:

- To send e-invoices over the protected European network, you must first request a Peppol ID. This ID gives you the possibility to send your e-invoices over the 100% safe Peppol network. Using this network is demanded by a lot of international government authorities.

- You can only send UBL invoices over the protected Peppol network (sending only PDF invoices is only possible as part of the UBL invoice). You can sign up at an access point to access this network.

Read more: How to Send a Peppol Invoice: Step-by-Step Guide for Compliance

What are the benefits of sending electronic invoices?

Sending electronic invoices has many advantages. Certainly when it comes to time, convenience, security, and speed when processing invoices.

Here are some specific examples:

- You save a lot of time within the accounting process (you no longer need to post invoices yourself).

- Paper flow becomes a memory only.

- Invoices no longer need to be scanned.

- Processing runs automatically.

- No invoicing errors.

- No printing or postage costs.

- Faster financial reports.

When a company switches to electronic invoicing, the manual process completely disappears. Think about downloading, logging in, and uploading your PDF invoice in the accounting package. An electronic invoice does not need to be scanned or forwarded to the auditor.

Because the invoices are immediately ready as a booking proposal, companies are also likely to pay your invoices faster. Even if the recipient does not open his or her accounting package until a week later, the payment is still faster than usual (manual bookings and payments have an average of 16 days).

Finally, the recipient knows that the invoice is error-free, as the invoice data is automatically converted into an XML file. This e-invoice can only be sent through the 100% safe Peppol network, which only allows verified senders and receivers. Thus, typos are no longer possible, and ghost invoices permanently belong to the past.

Read more: Reselling vs. Building E-invoicing Solutions: A Strategic Decision for ERP Integration Companies

Want to send e-invoices yourself?

Would you like to send and/or receive e-invoices yourself? You can easily get started by following the steps below.

First, make sure you have a Peppol ID. This ID makes it possible to send electronic invoices over the protected Peppol Network.

You can request a Peppol ID for free:

- Create a free account here.

- Navigate within your account to Send > Peppol.

- Click 'Create Sender' and enter your company information. Your information will be stored safely and will never be shared with others.

- Choose delivery via 'Protected Email' or 'API'.

- Now click 'Save'. Your Peppol ID is now awaiting verification (this will typically take 1 day). You will receive an email when the verification is complete.

Read more: Download our free Peppol Whitepaper

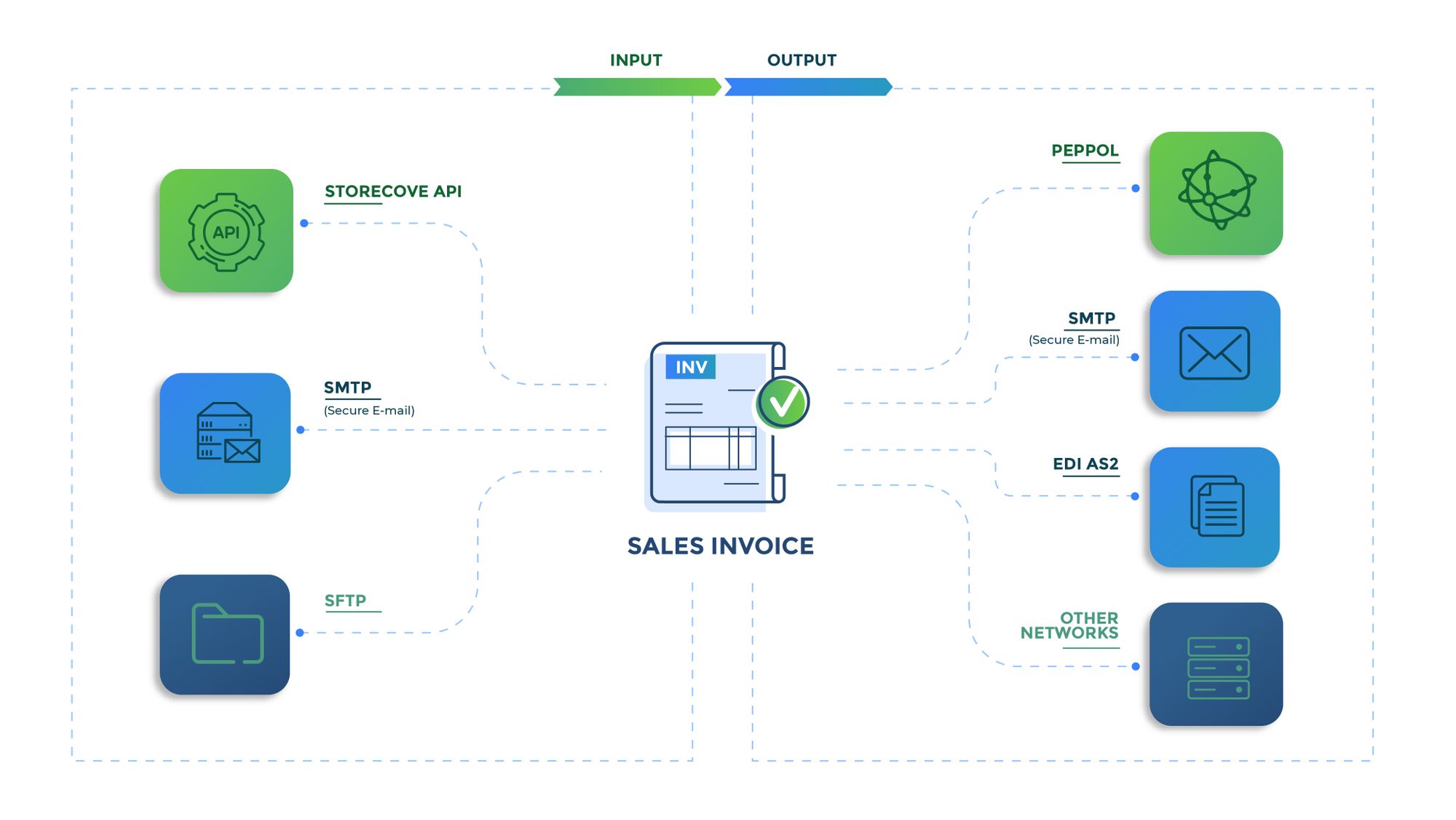

Using an international E-invoicing platform

Do you need to send e-invoices to international companies or public entities? You can use Storecove to safely sending your UBL invoices worldwide.

We convert your invoice format to the format required by the receiver. This makes you able to send e-invoices to companies and governments in many countries, such as:

- Croatia

- Italy

- The Netherlands

- Belgium

- Germany

- Norway

- Sweden

- Finland

- Canada

- The United States (USA)

- Singapore

- Australia

- New Zealand

- South Africa

- And many more.

All the invoices are sent via the 100% secure Peppol network.

Book a demo with our team to get started.

Want more information about electronic billing?

Want to know more about the benefits of switching from paper invoices to electronic invoices?

Schedule a consult with our e-invoicing experts or contact us with any questions. We're here to help.

Read also:

Comments