E-invoices issued to public entities in Belgium's Flanders and Brussels regions must be sent through the Peppol network using the Peppol BIS format. However, there is legislation to extend B2G e-invoicing from its current regional application to a nationwide application, and there are ongoing plans also to mandate B2B e-invoicing.

Belgium adheres to Europe’s vision of the Digital Agenda, which identifies the generalization of e-invoicing and e-procurement as a means of efficiency. It’s estimated that the generalization of e-invoicing in Belgium will bring savings of about EUR 3.5 billion per year.

However, what are the technical and legal requirements for e-invoicing in Belgium? We’ll answer this question in this article. Specifically, we’ll look at:

- E-invoicing rules and regulations in Belgium, with regards to e-invoicing infrastructure, e-invoice issuance, formats, e-signature, archiving

- Who must comply with e-invoicing regulations in Belgium

- How to send and receive compliant e-invoices in Belgium

- How Belgium ensures e-invoicing compliance

E-Invoicing rules and regulations in Belgium

The e-invoicing landscape in Belgium is rapidly developing. Hereunder, we’ll examine the e-invoicing rules and regulations in Belgium.

E-invoicing infrastructure in Belgium

The Belgian government identifies Peppol as an interoperability framework for the effective, timely, and safe delivery of electronic invoices from any sender to any receiver. While Peppol is mandatory for B2G transactions, it is voluntary for B2B transactions.

In 2015, BOSA-DT, the Department of Digital Transformation (DT) of the Federal Public Service Policy and Support (Beleid en Ondersteuning / Stratégie et Appui - BOSA), conducted a pilot on the feasibility of B2G e-invoicing.

Know that BOSA-DT is in charge of promoting good practices in Belgium’s IT sector, so advancing the generalization of electronic invoicing fits into its mandate.

From the pilot, BOSA-DT concluded that an interoperability framework was necessary for B2G e-invoicing. Since Peppol is the only comprehensive interoperability framework available, Belgium joined Peppol in 2016, becoming the 6th country to do so.

BOSA-DT has been Belgium’s Peppol Authority since 2016. Since then, BOSA-DT has been promoting the generalization of Peppol e-invoicing and e-procurement in Belgium.

The Belgian government has a B2G e-invoice solution called Mercurius, which it now integrates with Peppol. All public entities can use the platform or connect directly with Peppol.

E-invoice issuing requirements

E-invoicing is currently compulsory for B2G transactions in the Flanders and Brussels regions of Belgium. However, Belgium is already seeking to expand the application of the existing B2G e-invoicing requirements nationwide. While B2B e-invoicing is voluntary, the country also intends to make it mandatory.

Belgium made B2G electronic invoicing mandatory in the Flemish and Brussels regions in 2017 and 2020, respectively. The Walloon region has shown an interest in e-invoicing, so the Belgian government has moved to expand the scope of the existing e-invoicing requirements nationwide.

The authorities have approved a draft Royal Decree for the nationwide introduction of B2G e-invoicing. It will be introduced in a phased manner based on the size of the contract.

The application will begin with large contracts, followed by medium-sized contracts, and finally by small contracts as follows:

- For all public contracts and concessions with an estimated value of EUR 215,000 or more, e-invoicing is expected to be implemented before October 2022.

- For all public contracts and concessions with an estimated value of EUR 30,000 or more, e-invoicing is expected to be implemented before April 2023.

- For all pubic contracts and concessions with an estimated value of less than EUR 30,000, e-invoicing is expected to be implemented before October 2023. However, public contracts below EUR 3,000 are exempt from the e-invoicing obligation.

In addition to the nationwide application of B2G e-invoicing, Belgium has also announced that it intends to follow the example of France and Poland to mandate B2B e-invoicing.

The Minister of Finance, Mr. Van Peteghem, made the announcement in late 2021. In his policy note, the minister stated that the intended nationwide application of B2B e-invoicing aims to reduce the VAT gap.

The government has not given timelines and specifications for the intended nationwide adoption of B2B e-invoicing. However, it is expected that the requirements will be based on the Peppol standard and that the adoption will follow a phased approach based on companies' sizes.

E-invoicing formats in Belgium

Peppol BIS is the mandatory format in the B2G context, but there is no mandatory format in the B2B context.

Belgian Authorities were already receiving Peppol BIS-compliant invoices before officially joining Peppol.

In the initial pilot program for B2G e-invoicing (2013 - 2014), the Belgian government developed Mercurius as the single gateway between the private and the public sector. The B2G e-invoice exchange solution is based on the ePRIOR platform developed and used by European institutions.

Interestingly, ePRIOR implements the same format as Peppol BIS, so e-invoices sent through Mercurius were Peppol-BIS compliant. Thus, when the government adopted Peppol and integrated Mercurius with the platform, there was no need to create additional formats for B2G invoicing. Therefore, it registered only the BIS format.

However, in the B2B space, the Belgian Peppol Authority supports the initiatives to use different formats. Contracting groups may choose to use the BIS format or any other format that better suits their needs. The overriding factor is recognizing the need for a lingua franca for interoperability.

E-signature requirement in e-invoices

Currently, Belgium does not mandate e-signatures for electronic invoices.

E-signatures on electronic documents have the same legal standing as conventional signatures on paper documents. That is, an e-signature authenticates an electronic document.

However, Belgium does not mandate e-signatures for e-invoices because the Peppol e-invoicing infrastructure guarantees the authenticity of the e-invoice.

Thus, you can perform B2G e-invoicing without using e-signatures. But in the B2B context, your use of e-signature solely depends on your contracting party's requirements.

Belgium’s e-invoicing archiving requirement

Belgium requires archiving e-invoices for movable property for seven (7) years.

Archiving is a requirement when performing electronic invoicing. Tax authorities require that companies archive a copy of their e-invoices for some years. It is a requirement because of future auditing purposes.

Belgian authorities require seven (7) years of archiving for accounting and tax documents.

- Accounting documents - Original accounting books and supporting documents that serve as the basis for accounting processes

- Tax documents - documents necessary for determining taxable income, documents required by VAT, documents related to the intra-community acquisition of goods abroad, etc.

Who must comply with e-invoicing regulations in Belgium

In Belgium, e-invoicing is currently mandatory for B2G transactions in the Flanders and Brussels regions and is optional for B2B transactions.

However, that is soon to change! As mentioned earlier, the Belgian government has already approved a decree to move from its current regional application of B2G e-invoicing to a nationwide application, using a phased approach that will end by October 2023.

Thus, bar a change in the proposed timelines, by October 2023, you’ll need an e-invoice for every B2G transaction anywhere in Belgium - at the national, regional, or local level.

Also, you currently do not need to perform e-invoicing in B2B transactions. But that also will change soon, as the government announced its intentions to make B2B invoicing compulsory soon.

How to send and receive compliant e-invoices in Belgium

You can send and receive compliant e-invoices in Belgium using three simple steps:

- Connect to a Peppol Access Point.

- Gather the necessities.

- Send your e-invoice to Peppol.

1. Connect to a Peppol Access Point

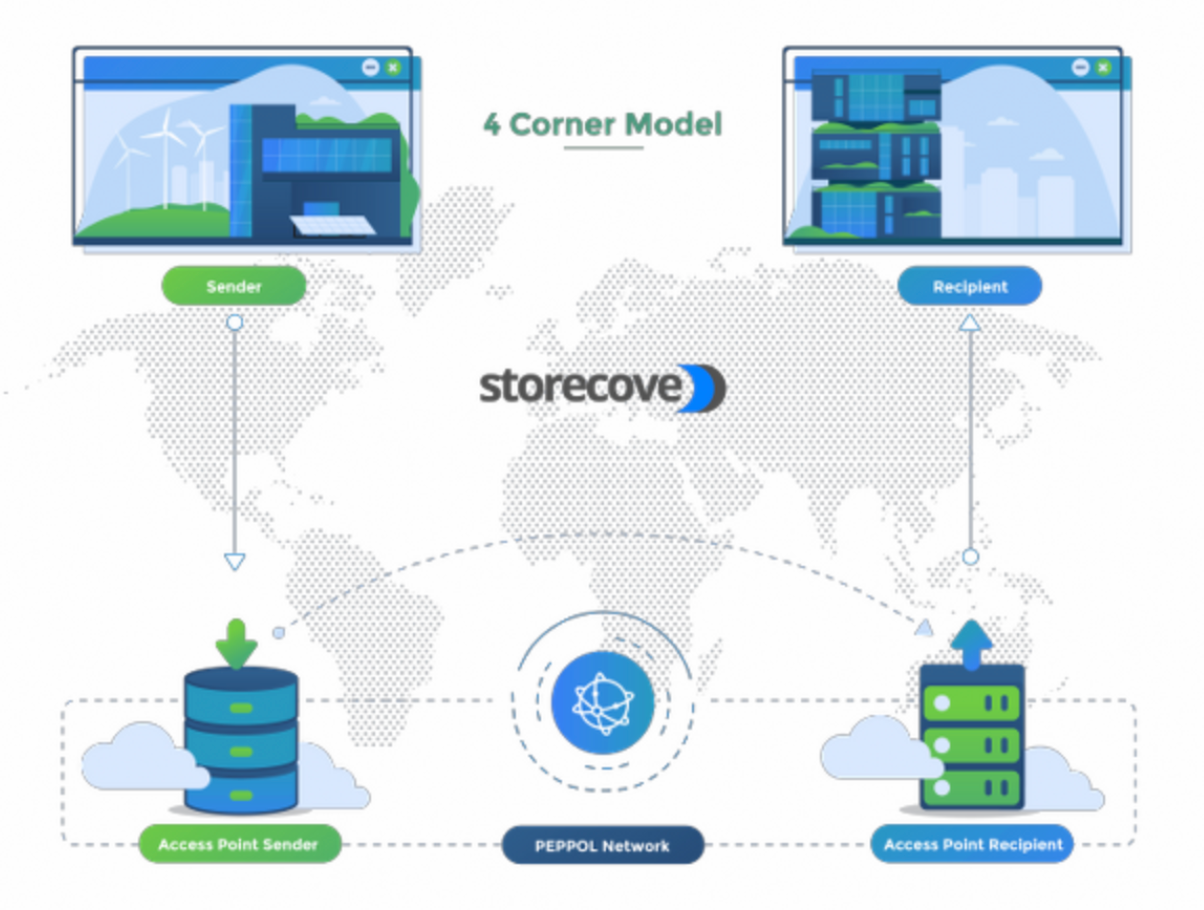

A Peppol access point is where your e-invoice is normalized in line with specifications to ensure it moves smoothly across the platform to your recipient.

Interoperability issues used to plague international transactions because of the multiplicity of e-invoicing formats. Different countries operate different invoice formats. So, when sending an e-invoice to another country, you need to determine the invoice format that your recipient uses so that you can create a compliant e-invoice.

The Peppol network solves the interoperability issue via Access Point providers. You need to connect to an Access Point to use the Peppol network. In the operation of the Peppol Network, your e-invoice goes from you to your Access Point provider, to the Access Point provider of the recipient, and finally to the recipient.

Interestingly, with an Access Point, you do not need to worry about the e-invoicing format of your recipient. At an Access Point, your e-invoice is converted to the correct format of your recipient, ensuring that you always send compliant e-invoices.

Storecove is one of the 40+ Access Point Providers approved by the Belgian Peppol Authority. Storecove will automatically convert your e-invoice to whatever format your recipient desires and safely transmit it.

In the Belgian context, Storecove will convert your e-invoices from your home country’s format to the BIS format required for B2G transactions and safely transmit it to the public entity.

2. Gather the necessities

You need to create the invoice you will send. The good thing is that you do not need to worry about the format used by Belgian public administrations.

You need to request your Peppol ID from your Access Point Provider. You’ll need the ID to send your invoice.

You also need to get and include your enterprise number on your e-invoice. Belgian authority strongly recommends using your enterprise number, delivered by the Belgian Crossroad Bank of Enterprises (CBE), as a primary identification number on invoices. Using the identification number guarantees proper routing of e-invoices.

3. Send your e-invoice to Peppol

With Storecove as your Access Point Provider, you only need to register, create a Storecove email address, and send the e-invoice to the email address.

- Register as a company in Storecove.com

- Fill in your company details to get a Peppol ID, which you need to send or receive e-invoices.

- Create a Storecove email address. To the question “How will Storecove receive the invoices you want us to send to your client,” select “Through Emails to @send.storecove.com,” and click on “+Add.”

- Send your e-invoice to the Storecove email address.

How Belgium ensures e-invoicing compliance

Belgium ensures e-invoicing compliance in several ways:

- Belgium recommends the Peppol network as the interoperability framework for effectively delivering e-invoices in the country.

- Belgium has selected BOSA-DT as its Peppol Authority to apply the interoperability framework in the country effectively.

- The Belgium Peppol Authority approves Access Points (AP) providers to provide entry and exit into the Peppol network.

- The Belgian government has developed Mercurius as a gateway between the private and sector, and it integrates the platform with Peppol for many synergies.

- Belgium organizes AP Providers’ forum every 6 - 8 weeks, where operators come together to handle various topics related to the development of Peppol in the country.

- The Belgian government has made e-invoicing compulsory for B2G transactions in some regions and is already seeking to extend B2G e-invoicing nationwide.

- The Belgian government has plans to extend e-invoicing beyond B2G transactions to B2B transactions.

Conclusion

If you supply a public entity in the Flander or Brussels regions of Belgium, Peppol e-invoicing is compulsory. However, the Belgian e-invoicing landscape is rapidly changing, and e-invoicing will be compulsory for all B2G and B2B transactions in a few years.

To send and receive compliant e-invoices through the Peppol network, the first step is to connect to a Peppol Access Point. Storecove is one of Belgium’s most reliable Access Point providers.

With Storecove’s e-invoicing solution:

- You can connect your business to the Peppol e-invoicing network.

- You will automatically comply with e-invoicing regulations.

- You can easily adhere to local tax authorities.

- You will save time and money on invoicing by automating the processing.

More information about Peppol in Belgium?

Contact us for more information or schedule a consult with one of our e-invoicing experts.

Read also:

Comments