Spanish businesses supplying public bodies must use an electronic invoicing system for all B2G transactions. The central platform for sending and receiving e-invoices in Spain is FACe, also known as Punto General de Entrada de Facturas Electrónicas.

FACe has been in use since the 2015 legislation that required all invoices sent to public bodies to be in a specific structured format. Electronic invoicing in Spain has continued to develop with new regulations introduced in 2018, such as the expansion of FACe to FACeB2B for businesses.

A draft bill on technical and software requirements was passed in 2021 and published on February 21, 2022. It will enter into force on January 24, 2024, giving suppliers and businesses enough time to comply.

In this article, we’ll look at the e-invoicing regulations in Spain, who they are meant for, and how you can send and receive compliant electronic invoices.

E-invoicing rules and regulations in Spain

When sending and receiving electronic invoices in Spain, you must adhere to rules and regulations regarding the platform and formatting structure.

The following are the requirements for successful e-invoicing in Spain.

1. Standard format FacturaE (XML)

The Spanish e-invoicing standard is called FacturaE and is based on XML. It is the only format you can use when sending invoices to public sector entities in Spain. The FacturaE format uses the UBL (Universal Business Language) standard.

2. Platform FACe (Punto General de Entrada de Facturas Electrónicas)

All e-invoices sent to public sector entities in Spain must be transmitted through the FACe platform. The Ministry of Finance manages the platform, and it’s the only way to send e-invoices to Spanish authorities.

3. VAT number

All businesses registered for VAT in Spain must include their VAT number on all electronic and paper invoices.

4. Archiving

The issuer of the electronic invoice must archive it for at least 5 years.

5. Identification number

Each business registered in Spain has a unique identification number called the NIF (Número de Identificación Fiscal). You must include this number on all invoices, both electronic and paper.

6. Software requirements

The software you use to generate and send e-invoices in Spain must meet specific requirements. The software must be able to:

- Generate invoices in the FacturaE format

- Sign invoices with an electronic signature

- Transmit invoices through the FACe platform

According to the draft bill on technical and software requirements published on February 21, 2022, by January 24, 2024, you should ensure the following of your system:

1. Your software developer or solution provider must certify in writing that the software complies with the new requirements and standards. The statement should be visible on the computer since the Spanish Tax Administration (AEAT) may ask for information to verify compliance.

2. The software must generate invoices in the FacturaE format and sign them with an electronic signature when sending and canceling.

3. The generated invoice must include the following:

- QR code that meets the technical and functional requirements provided by the Spanish Tax Administration (AEAT).

- A narrative "Invoice verifiable at the electronic headquarters of the AEAT" or "VERI*FACTU" where the computer system sends all the invoicing records to the AEAT.

- Alphanumeric identification code.

4. The Spanish Tax Administration (AEAT) will have the right to access, request, and receive information from anyone, including businesses for billing records and software developers, to verify compliance with the requirements.

5. Your system should be able to generate "registration billing records" while issuing an invoice or immediately before.

6. The software must be able to send all your billing records to the Spanish Tax Administration (AEAT) electronically in the form of a ZIP file. The ZIP file must include a FacturauraE invoice for each customer, an XML file with the billing data, and a PDF file with the invoice in human-readable form.

7. All your registration billing records should include the following information:

- Name and tax identification number of the party issuing the invoice

- Name and tax identification number of the party to whom the invoice is addressed

- Data and time

- Type of invoice

- Unique invoice number

- Consecutive series of the invoice

- The total amount of the invoice, including taxes

- Reference to the applicable legal regulation

- Tax identification number of the issuer.

Who must comply with e-invoicing regulations in Spain?

According to the 2015 legislation, all invoices involving public contractors and subcontractors should be signed and submitted electronically through the FACe platform. And since 2018, FACeB2B extended this option to businesses making B2G transactions or those under EUR 5,000.

According to the approved law published on February 21, 2022, all businesses and self-employed individuals registered in Spain will be required to use e-invoicing for their B2B, B2G, and intrastate sales starting from January 24, 2024.

How to send and receive compliant e-invoices in Spain?

The most common way to send and receive e-invoices in Spain is through the FACeB2B platform or a service provider. FACe was initially created for public entities and their contractors, but it's now available to businesses of all sizes.

If a company is issuing an invoice over EUR 5,000, it must use the FACeB2B platform. If the amount is below EUR 5,000, businesses can voluntarily use the FACeB2B.

An invoice is only recognized if it complies with the FacturaE format. It should include the following information:

- Name of the corporation: The corporation name is crucial to businesses, as this is the legal name under which a company is registered. The name should be included on every invoice page and be easy to read.

- VAT identification number: It is a 9-digit code assigned to businesses by the Spanish Tax Agency. You should include it on every page of the invoice.

- Legal or tax address: It is the business's registered address and should also be included on every page of the invoice.

The FACeB2B platform has no portal where you can upload invoices. It is a web service that sends, cancels, downloads, and obtains invoice information.

Using FACeB2B

Sending an electronic invoice using the FACeB2B platform is typically a three-step process that includes:

1. Registration

To start using the platform, your company must first register for FACeB2B. You must have a Directorio de Entidades (DIRe) to register.

2. Invoice requirements

After registration, you need to ensure that your e-invoices meet all the XML schema requirements. This includes having a QR code, an image of the company's logo, and a digital signature. Currently, B2B users don't have to include an electronic signature.

3. Generating the invoice

The last step is to generate the e-invoice using the platform. You can use the web service or a software application to do this and convert it into a format that can be read and processed in the ERP system.

Using a provider

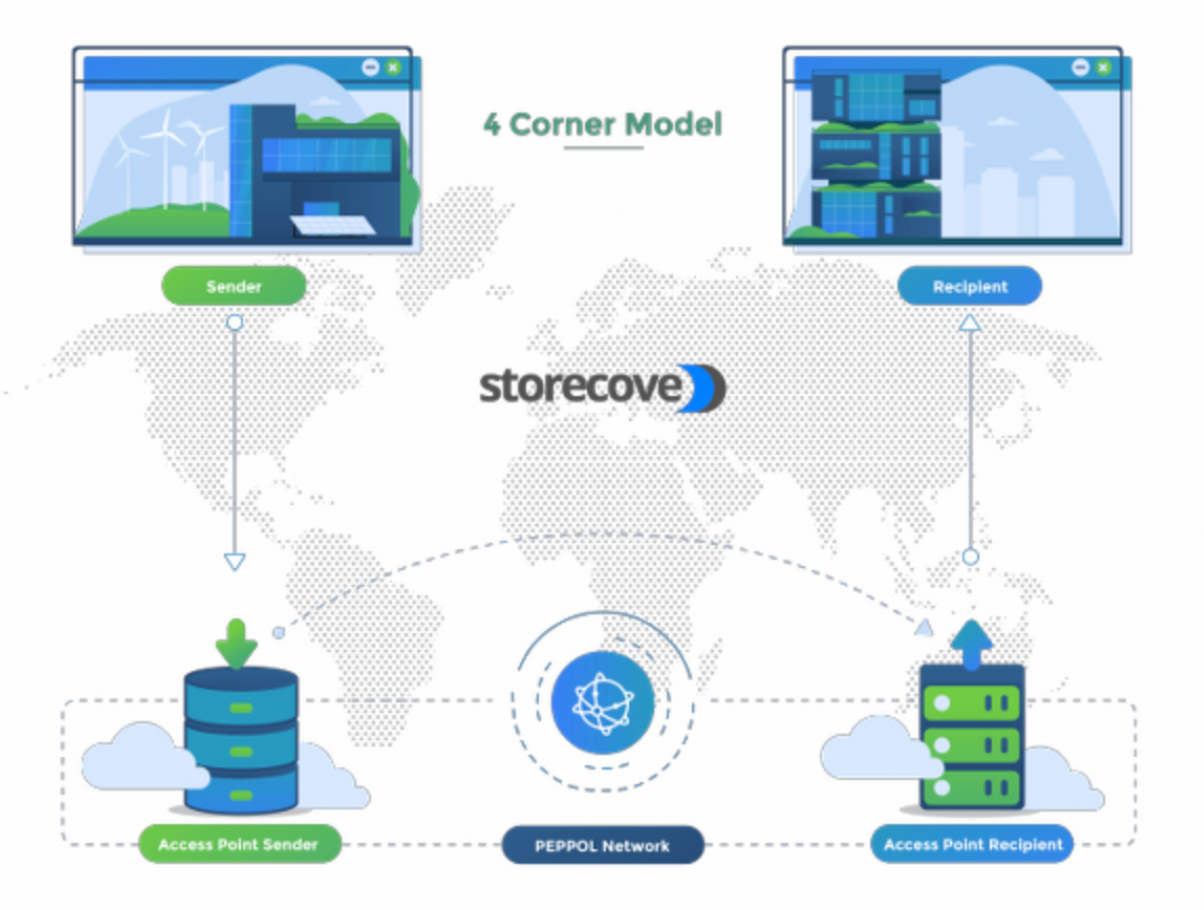

You can also transfer electronic invoices in Spain using the e-invoicing services of a provider like Storecove. The provider manages the integration and offers a web interface for viewing, downloading, and sending e-invoices. The process involves the following steps:

1. Exporting and converting invoices

The first step is to export invoices from your accounting software in a PDF or XML format to your provider. Once the file is exported, they convert it into a valid FacturaE document.

2. Sending the e-invoice

After the file is converted, your provider will send it to the recipient through the FACeB2B. The recipient has to be registered to the platform for them to get the invoice by downloading it. To confirm if the recipient is registered, you can enter their DIRe code to check availability.

3. Forwarding status

Once the recipient accepts the invoice, your provider forwards the status to your software. You can now see if the e-invoice was received, accepted, or rejected by the buyer. Your provider should be transparent about the status of your invoices and ensure you can view them directly on your ERP system.

Using a service instead of the FACeB2B platform has a few benefits. First, it's easier to send and receive e-invoices using a provider since the latter manages the integration and offers a web interface for viewing, downloading, and sending e-invoices.

Second, you don't have to worry about the technical aspects of e-invoicing, as the provider takes care of that for you. All you need to do is export your invoices from your accounting software, and the provider will take care of the rest.

Finally, using a provider can save you time and money because they will manage the integration and ensure that your e-invoices are compliant with the latest regulations.

How does Spain ensure e-invoicing compliance?

Spain has a few measures in place to ensure that businesses comply with the e-invoicing regulations.

The first is the platform in use. The FACeB2B platform is only available to businesses registered with the Spanish Tax Agency. It ensures that only businesses compliant with the Spanish tax laws can use the platform.

The second measure is the format accepted. The platform will accept only invoices in the FacturaE format that meet the XML schema requirements. It ensures that all e-invoices are compliant with the latest regulations.

Conclusion

E-invoicing compliance in Spain is essential for businesses using the FACeB2B platform. The current rules and regulations require all businesses to register with the Spanish Tax Agency and FACeB2B platform.

By January 24, 2024, all businesses must comply with the new rules and regulations. They mainly focus on requirements for the systems and software in use. Businesses can partner with a service provider like Storecove to avoid the challenges with compliance. The provider will manage the integration and ensure that all e-invoices are compliant with the latest regulations.

More information about E-Invoicing Compliance in Spain?

Contact us for more information or schedule a consult with one of our e-invoicing experts.

Read also:

Comments