Electronic invoicing is a process that allows businesses to send and receive invoices in an electronic format. From January 1, 2020, the Ministry of Finance and Economic Affairs in Iceland made e-invoicing a requirement for all economic operators submitting invoices and all central, regional, and local contracting authorities receiving and processing invoices.

Electronic invoicing saves time and money for both the sender and the recipient of an invoice. It is the reason why the ministry responsible for e-invoicing in Iceland only allows e-invoices compliant with EN 16931 CIUS (TS-236).

In this blog post, we will explain the process of e-invoicing in Iceland, why the government implemented it, and what compliance means for businesses.

E-invoicing rules and regulations in Iceland

To share and receive electronic invoices with businesses and government organizations in Iceland, you must stick to formatting and issuing requirements.

Mandatory formatting

When sharing invoices in Iceland, you have to use either of the following formats:

1. U.BL 2.1

Icelandic e-invoicing standards are based on the European norm EN16931. The U.BL format is an XMLinvoice standard that supports the requirements of EN 16931. It is also the recommended standard for e-invoicing in Iceland.

2. PEPPOL BIS Billing 3.0 CIUS

PEPPOL is an EU-sponsored initiative that uses open standards to facilitate the exchange of electronic documents between businesses. The PEPPOL BIS Billing 3.0 CIUS format is based on the U.BL 2.1 standard and supports the requirements of EN 16931.

Issuing requirements

To issue e-invoices in Ireland, you need to ensure your invoice has the following details:

- Name and address of the supplier and customer

- Invoice number

- Due date and date of issue

- Product or service description: Quantity, price per item

- Total amount

- Bank account to make it possible to pay through bank transfer

- Tax rate and supplier's VAT number

- Any discounts or early payment terms

Archiving

Archiving is a crucial part of e-invoicing required and regulated by the governing body. When using e-invoicing in Iceland, you need to store your invoices for up to 7 years. You can also archive your invoices abroad, but on certain conditions, as detailed below:

- The country where you store your invoices needs to have an agreement with Iceland that ensures the safety and security of the data.

- You need to have a valid reason for storing your invoices abroad (for example, if your primary storage system is outside Iceland).

- The ministry responsible for e-invoicing in Iceland needs to be notified of your decision to store your invoices abroad.

Platform

Iceland's economic operators can send and receive their electronic invoices through the Peppol network. It is a pan-European network of national and international e-invoicing service providers.

The ministry responsible for e-invoicing in Iceland recommends using Peppol. It is an interoperable platform that makes it possible to connect with businesses and government organizations in Iceland and other countries.

Who must comply with e-invoicing regulations in Iceland?

Electronic invoicing in Iceland is mandatory for all recipients, including central, regional, and local contracting authorities and entities. All businesses sending invoices to government organizations should also adhere to these regulations.

Businesses need to use a certified e-invoicing system to ensure compliance. This system can be provided by a value-added network (VAN) or a Certified Service Provider (CSP).

Your certified e-invoicing system should be able to:

- Issue invoices in the U.BL 2.1 or PEPPOL BIS 3.0 CIUS formats

- Archive invoices for up to 7 years

- Store invoices in a secure and certified location

- Send invoices electronically to the buyer

- Receive invoices electronically from the supplier.

How to send and receive compliant e-invoices in Iceland

It is highly recommended that the sender publish the invoice in their system and distribute it through a message server. If your business does not have an accounting system, you can easily find an effective and affordable one on the market that allows you to keep track of your accounts.

There are two ways to send and receive compliant e-invoices in Iceland:

Use Peppol Network

The Peppol platform allows you to connect with other businesses and government organizations to exchange invoices electronically.

In this process, businesses first need to connect to the Peppol network. Once connected, companies can search for and identify their trading partners and share invoices. To use the Peppol network, you need to follow the three steps below.

1. Create a profile

You need to create a profile on the Peppol network to get started. You can do this by registering on the Peppol site and providing your company information, including your business name and address.

2. Select the receiver

After you have registered and created a profile, you need to select the organization you want to send your invoice to from the Peppol network.

3. Enter details and send your invoice

Once you have selected the organization, you need to enter the relevant invoice details and hit send.

The Financial Management Authority of the Government of Iceland (FJS) processes invoices on behalf of all government agencies in Iceland. FJS operates electronic mailboxes for invoices and other messages received through the Peppol network.

You can identify any Iceland government agency using its Icelandic legal identifier, Kennitala. The Kennitala always consists of an ICD scheme code, for example, 0201234567.

Unfortunately, it is currently impossible to register on the Peppol network and send invoices directly to recipients. However, you can opt for the second method.

Use a PEPPOL Access Point Provider

If you want a more hands-off solution, you can use a PEPPOL Access Point provider. A PEPPOL Access Point provider is a certified provider that helps businesses connect to the Peppol network.

PEPPOL Access Point providers offer free services for businesses until a specific amount of invoices. After that, they might charge a small monthly or per-transaction fee.

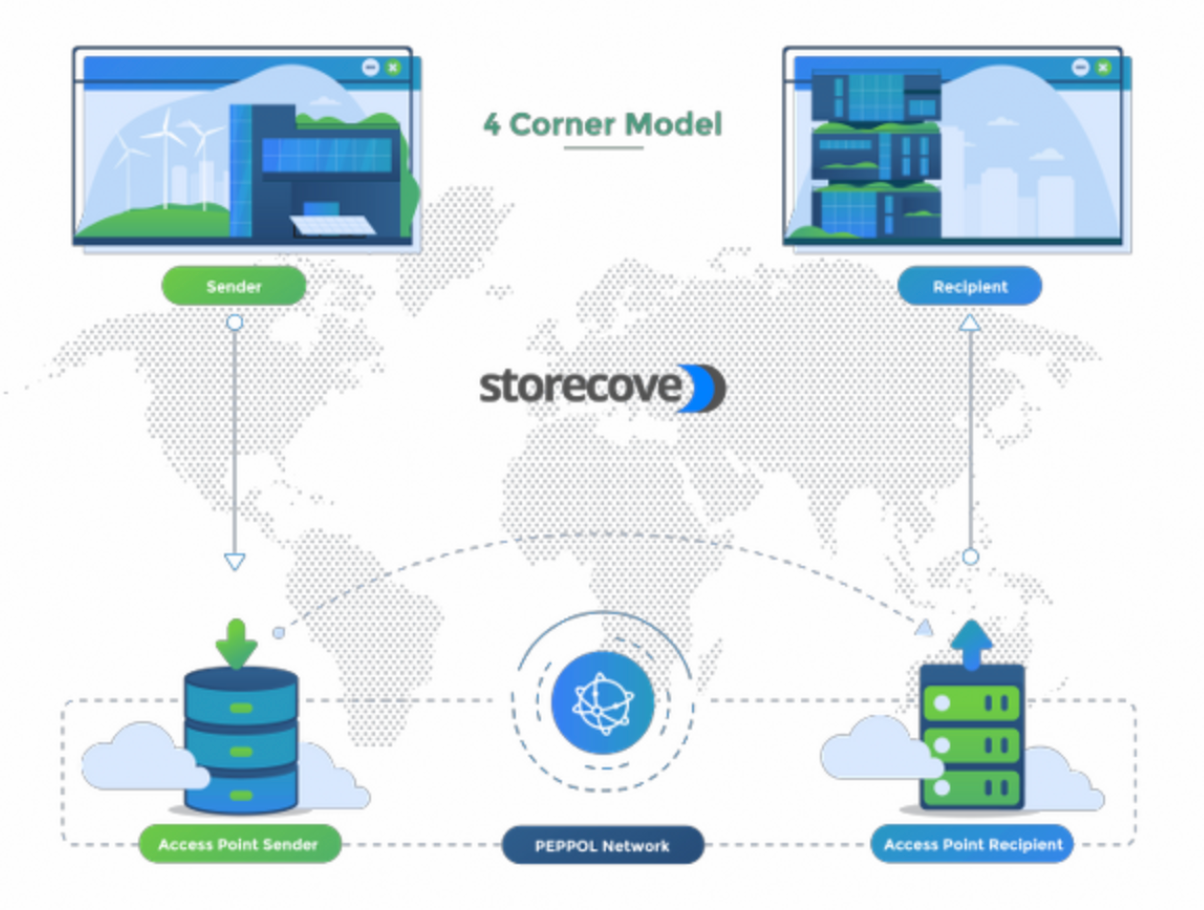

The PEPPOL network is a four-corner model, which means that businesses connect with both their suppliers and the network provider to exchange invoices.

To use a PEPPOL Access Point provider, you first need to find a provider that suits your business needs. Once registered, businesses can start sending and receiving invoices via the Peppol network following the steps below:

1. Find a reliable provider

To start using a PEPPOL Access Point provider, you need to find a reliable provider like Storecove that fulfills your business needs. You can do this by searching for certified providers on the Peppol website.

2. Get connected

After finding a suitable provider, you need to get in touch and sign up for an account. Once you have an account, you will be able to send and receive invoices via the Peppol network.

3. Start using the system

Once you're connected, you can start sending and receiving invoices electronically.

The four-corner model works efficiently when all the parties involved stick to their roles. The model includes:

- Sender: It is the organization that sends the invoice. The sender needs to have an account with a PEPPOL Access Point Provider.

- Sender Peppol Access Point: It is the provider that the sender uses to connect to the network. The provider helps deliver the invoice to the receiver.

- Receiver: It is the organization that receives the invoice. The receiver also needs an account with a PEPPOL Access Point Provider.

- Receiver Peppol Access Point: It is the provider used by the receiver to connect to the network. The provider helps deliver the invoice from the sender.

How Iceland ensures e-invoicing compliance

When sending an e-invoice, businesses must ensure that the invoice adheres to specific standards. These standards are set by the Icelandic government and the European Union (EU).

Iceland's government doesn't impose e-invoicing through regulations or legislation. However, the accounting authority, FSJ, on behalf of the Ministry of Finance and Economic Affairs, does not accept e-invoices that don't comply with the Peppol standards.

The EU has set e-invoicing standards for businesses that want to trade with public entities in EU countries. The standards are called the European Standard EN16931.

The standard includes:

- Format of the e-invoice

- Metadata of the e-invoice

- Structure of the XML file

If an invoice doesn't comply with the standards, the recipient might reject it.

Conclusion

E-invoicing compliance in Iceland is essential for businesses that want to trade with public entities. The government has set standards that businesses need to adhere to. These standards are set by the accounting authority, FSJ, on behalf of the Ministry of Finance and Economic Affairs.

Businesses need to use a PEPPOL Access Point Provider such as Storecove to ensure compliance. Storecove is a certified provider that helps businesses connect to the Peppol network and exchange invoices.

More information about E-Invoicing Compliance in Iceland?

Contact us for more information or schedule a consult with one of our e-invoicing experts.

Read also:

Comments