The e-invoicing in Mexico, known as the CFDI, was created in 2004 and has continued to evolve, bettering users' experience. Mexico is one of the earliest countries to implement XML-based electronic invoicing and has been a trendsetter in the Latin American region. Businesses that have not digitized their invoices are at a loss as they are missing out on the benefits of e-invoicing.

E-invoicing can help businesses become more efficient and improve communication with suppliers. The Authorized Certification Provider (PAC) in Mexico's electronic invoicing system is responsible for validating, certifying, and timestamping digital signatures on invoices. The PAC is also responsible for providing the required CFDI certificate, CSD (Certificado de Sello Digital), to businesses.

Every PAC has to be certified by the Mexican tax authority (SAT) to be able to provide digital signatures.

In this article, we’ll discuss how businesses can stay compliant with e-invoicing regulations when sending and receiving invoices in Mexico. We will also look at the significant electronic invoicing update in Mexico that will be mandatory by July 1, 2022.

E-invoicing rules and regulations in Mexico

Every business that wants to start using e-invoicing in Mexico has to adhere to the rules and regulations of the Mexican tax authority (SAT). They include:

Required administrative transactions

You must have a digital certificate called an electronic signature key (FIEL or e.firma) that you can use to apply for the CSD. You can obtain the FIEL from the SAT website or any accredited providers.

Digital signature

The issuer must sign the CFDI with a digital signature and add the corresponding CSD to make the invoice valid. There is also a second digital signature known as the “Digital Seal.” It is generated by the Mexican tax authority (SAT) and accredited by PAC after verifying and validating the invoice.

Fiscal control

The "Digital Seal" gives your invoice validity before SAT. After that, your invoice goes through a fiscal control process in which the SAT verifies that the information included in the CFDI is accurate. SAT makes it available to the issuer and recipient in their tax portals if it is valid.

Print format

The graphical presentation of the CFDI XML is regulated and must contain a two-dimensional barcode linking it to an official SAT page to verify authenticity.

Archiving

Issuers and recipients must archive invoices for five years according to NOM151, which grants legal guarantees to documents stored electronically.

Format

All electronic invoices should be in a Comprobante Fiscal Digital por Internet (CFDI) structure, an XML file, and a readable PDF version. The current CFDI version 3.3 will become obsolete on July 1, 2022, and businesses will have to start using CFDI version 4.0.

The CFDI 3.3 version that the Mexican government implemented in 2017 had some significant changes, such as the inclusion of new document types, the addition of “Payment Complement” (Complemento para Recepción de Pagos or just Pagos) for reporting payments received, and more.

The most notable change in CFDI 4.0 is the migration from XML 1.0 to XML 1.1, which will result in smaller file sizes. Other changes include:

- Addition of reason for canceling invoices with four standard options

- Addition of “Payment Conditions” (Condiciones de Pago)

- Inclusion of “Issuer” (Emisor) in the XML

- Addition of “Credential” (Credencial) element in “RelatedDocument” (DocumentoRelacionado)

- Addition of a new “Discrepancy” (Discrepancia) element

- The “Payment” (Pago) element has been modified

- The “PaymentTerm” (Condiciones de Pago) element has been modified.

The Mexican Tax Administration Service (SAT) has allowed a three-month transition from CFDI 3.3 to CFDI 4.0 starting April 1, 2022. After July 1, businesses will have to use CFDI 4.0 for all their invoicing needs. SAT has informed all PACs in advance so they can make the necessary changes to their systems.

Who must comply with e-invoicing regulations in Mexico?

Mexico was among the first countries to implement electronic invoicing and has had adequate time to make improvements and adjustments to the system. Since 2011, all large taxpayers in Mexico have been mandated to use electronic invoices and live reports to tax authorities. Later in 2013, the Mexican government extended the mandate to all businesses.

How to send and receive compliant e-invoices in Mexico

The following are the steps involved in sending and receiving electronic invoices in Mexico:

1. Obtain the e.firma

The first step toward sending and receiving compliant electronic invoices in Mexico is obtaining a digital certificate called an electronic signature key (FIEL or e.firma). The e.firma comprises two keys: the private key and the public certificate.

Every user has to generate a private key from their computer or at the SAT offices when acquiring the e.firma. On the other hand, the public certificate is obtained from the SAT website or any accredited providers. It contains information such as your taxpayer registration number (RFC), business name, address, and SAT accreditation number.

During the on-site appointment at SAR, the officials validate your identity using your documents and capture your biometric information such as fingerprint, iris scan, and handwritten signature. Once they verify your identity, SAT certifies your request and generates your public certificate.

2. Signing up for a PAC

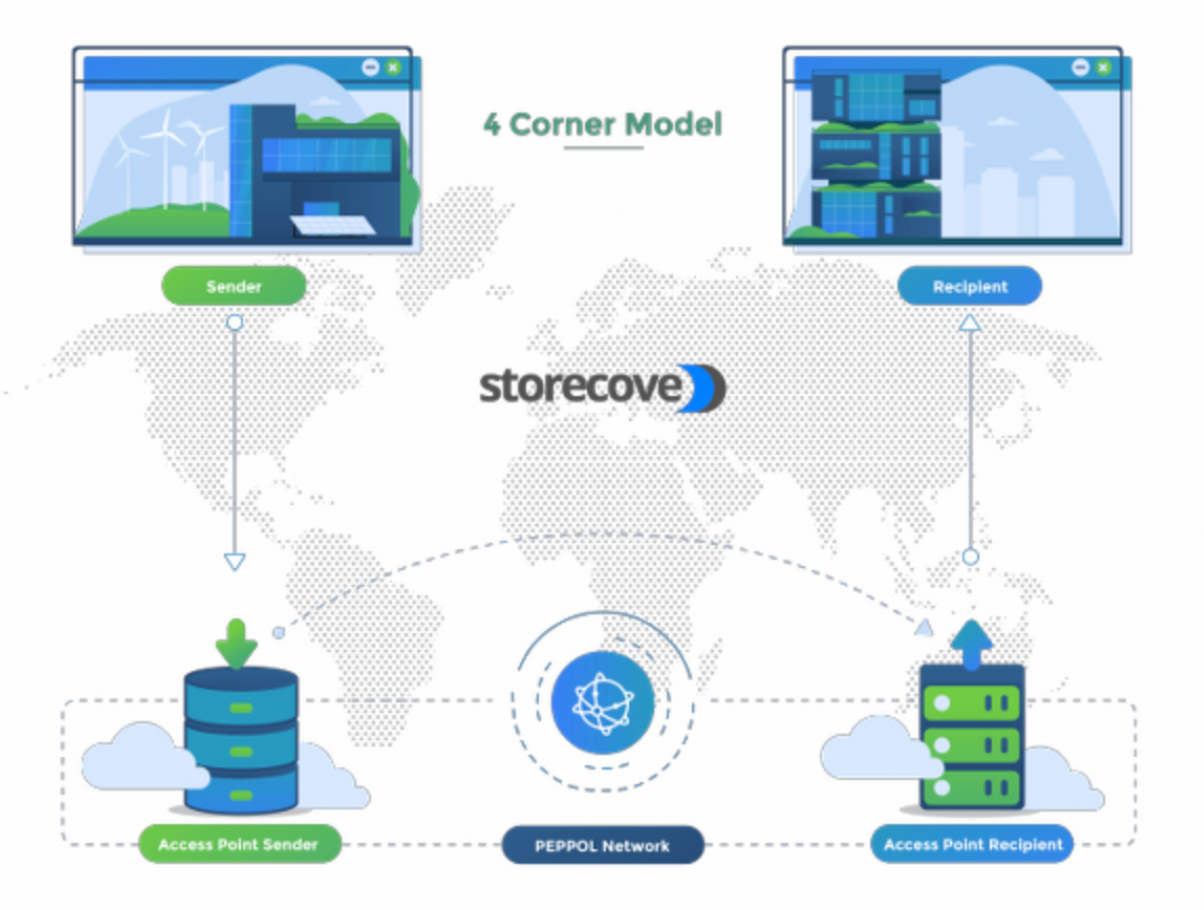

After you have obtained the e.firma, the next step is signing up to an Authorized Certification Provider (PAC) such as Storecove, who will help you apply for the certificado de sello digital (CSD or digital seal certificate). The CSD is required to create the “Digital Seal” that gives your e-invoices legal validity in Mexico.

3. Create the CFDI

The next step is to create the CFDI XML, which can be done using your software or provided by your chosen PAC, such as Storecove's. The XML must contain all the required information, such as the issuer and recipient's taxpayer registration number (RFC), the date, time, amount, UUID, etc.

4. Apply the digital signature

After you have generated the CFDI XML, the next step involves applying the digital signature using your e.firma. This will encrypt the XML and make it tamper-proof.

5. Create the “Digital Seal”

The next step is creating the “Digital Seal,” done using the CSD. The digital seal is a timestamped signature generated by the SAT and validates the authenticity of the CFDI.

6. Send the CFDI

Once you have generated the CFDI XML and applied the digital signature and “Digital Seal,” the next step is sending it to the PAC for verification and validation before forwarding the stamped CFDI to SAT.

7. Receive the CFDI

After the PAC has verified and validated the CFDI, they will forward it to SAT, who make it available to the issuer and recipient in their tax portals. The recipient can then download the PDF version of the CFDI, which contains a QR code linking to the official SAT page where the CFDI can be verified.

How Mexico ensures e-invoicing compliance

In Mexico, e-invoicing compliance is ensured by the SAT, which is responsible for issuing the e.firmas, validating CFDIs, and maintaining the tax portals where CFDIs are made available. The SAT also monitors businesses to ensure they use compliant software and report their e-invoices accurately.

Conclusion

Electronic invoicing in Mexico is mandatory for all businesses. Large companies have been using electronic invoices since 2011, and the Mexican government extended the mandate to all businesses in 2013. The SAT is responsible for issuing e.firmas, validating CFDIs, and monitoring businesses to ensure e-invoicing compliance.

When sending electronic invoices in Mexico, you need an Authorized Certification Provider (PAC) such as Storecove to ensure compliance. Storecove's solution makes it easy to generate CFDIs, apply digital signatures, create “Digital Seals,” and securely send CFDIs to the SAT for validation.

More information about E-Invoicing Compliance in Mexico?

Contact us for more information or schedule a consult with one of our e-invoicing experts.

Read also:

Comments