Since January 2019, all VAT-registered businesses have been mandated to issue and receive invoices electronically using Sistema di Interscambio (SdI), Italy's e-invoicing platform. This requirement has made Italian businesses evolve and stay up-to-date with the regulations for compliance.

The e-invoices are processed by the central, regional, and local authorities, and the data contained in the invoices helps track taxes. The Italian Revenue Agency (Agenzia Entrate) has set rules for the standard format (FatturaPA (XML)) of electronic invoices.

This move by the Italian government was aimed at helping deal with tax evasion, VAT fraud, and money laundering. Businesses could also benefit from fast payment, reduced administrative costs, and improved efficiency.

The law applies to any type of sales conducted by public agencies B2B (business-to-business), B2C (business-to-consumer), and B2G (business-to-government). It helps reduce Spesometro invoice listings and Intrastat VAT declarations that makes paperwork and accounting burdensome.

In this easy checklist, we’ll provide an overview of the Italian e-invoicing requirements to help you comply and understand how to send and receive compliant invoices.

What are the e-invoicing rules in Italy?

The law on mandatory e-invoicing in Italy was enacted on January 1, 2019. It stated that all invoices created by VAT-registered businesses must be issued and exchanged through the Sistema di Interscambio (SdI) platform.

Italy also introduced mandatory e-invoicing requirements for all cross-border transactions, which took effect in July 2022. Businesses with any kind of cross-border activity are required to use the e-invoicing system for invoices issued in Italy and beyond.

The Italian Tax Authority has set the FatturaPA (XML) format as the standard format for sharing e-invoices. All public bodies in Italy accept the structure.

You can add a digital signature using a secure device before sending an invoice via SdI. The signature helps to guarantee the authenticity and integrity of data and proof of its origin, but it is not mandatory for B2B.

Who needs to comply with the e-invoicing regulations in Italy?

The regulations set by the Italian government apply to any company registered in Italy and doing business with other VAT-registered businesses. All e-invoices issued or received, including those with foreign companies, must be exchanged through SdI.

Here are the parties that are required to comply with the e-invoicing regulations in Italy:

Public administrations

When making any sales, public administrations such as the Italian government, local authorities, and regional bodies must use the SdI network to send invoices.

This process helps track payments and detect any discrepancies. It is a great way to prevent fraud and money laundering within the government.

Private companies

Any private company with a VAT registration number must exchange invoices via the SdI to comply with Italian e-invoicing regulations. This includes businesses in B2B and B2C transactions, such as retailers, wholesalers, and manufacturers.

International companies

In July 2022, the Italian Tax Authority made it mandatory for international businesses conducting cross-border transactions with an Italian-registered company to comply with their electronic invoicing laws. They should send and receive cross-border invoices in the FatturaPA (XML) format and use SdI for exchanging invoices.

How to send compliant e-invoices in Italy?

The Italian Tax Authority has provided various methods businesses can use to send, receive, and process transactions. They include:

FatturaPA web interface

You can use the FatturaPA web interface to manually send electronic invoices if you hold either Entratel or Fisconline credentials or have a National Service. An employee of your Italian branch with signing power will have to register you with FatturaPA.

After registration, you must choose a technical contact to set up the connection. You will also need them to monitor it regularly as you make your transactions.

Luckily, you can avoid this by hiring an access point provider like Storecove to submit and receive invoices on behalf of the company. It saves you the hassle of going through a lengthy registration process while minimizing your tasks.

Read Also: What Is An Electronic Invoice?

The following are steps to follow for e-invoicing in Italy:

1. The ERP automatically creates the invoice

Every business should have Enterprise Resource Planning (ERP) software automatically generating e-invoices. The invoice can be in any ERP format but should include all the details required by the FatturapPA format.

After generating an electronic invoice, the ERP sends it to the service provider.

2. Service provider extracts and translate ERP data

Your service provider will extract data from the e-invoice and translate it into FatturaPA. The access point providers stay up-to-date with all e-invoicing regulations in Italy since they serve many businesses.

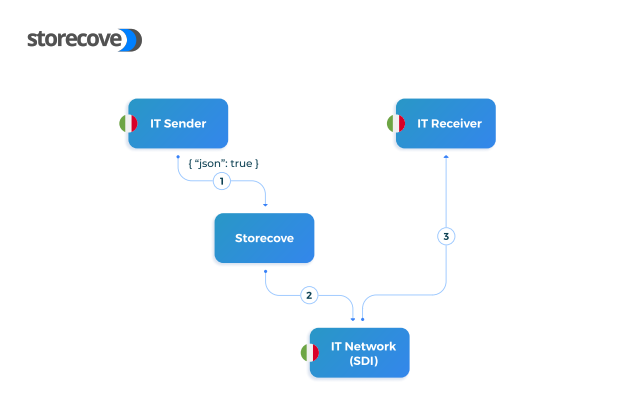

3. Transfers invoice through SdI

Your provider uses web service via SdI to transmit the invoice electronically. The Italian Tax Authority receives and validates it and sends a receipt confirmation to you. The receipt can be negative or positive.

You get a negative receipt when you enter the wrong recipient ID or omit some of the required information. If you receive a positive confirmation from SdI, the invoice was received successfully.

4. SdI forwards the invoice to the final recipient

After verification, SdI forwards the invoice to the final recipient, who accepts and processes it. If the recipient does not receive the invoice within fifteen days, the SdI system automatically issues an expiration note that results in voiding.

Characteristics of the electronic invoice in Italy

Every electronic invoice issued in Italy must adhere to certain rules. Here are the characteristics each should feature:

Format

The Italian government has set FatturaPA, which uses the InvoicePA XML format as the standard for issuing and receiving e-invoices.

Digital signature

The SdI accepts two signature formats: CAdES-BES (CMS Advanced Electronic Signatures) and XAdES-BES (XML Advanced Electronic Signatures). The digital signature is made by a secure invoice signature generator device that your provider should have.

CAdES-BES (CMS Advanced Electronic Signatures)

This digital signature type is made up of a cryptographic envelope containing the signed message and other information, such as signer identification, time stamp, and signature validity. It is the most commonly used signature in Italy.

XAdES-BES (XML Advanced Electronic Signatures)

The XAdES-BES is an advanced type of signature that follows the XML-DSig standard. It is used to secure transactions with a higher level of integrity than the CAdES format. The signature comprises a combination of cryptographic, canonicalization, and XML elements.

Obligation

All VAT-registered public entities and private companies should send, receive, and process e-invoices.

According to the decree law of April 30, 2022, electronic invoicing will become mandatory for taxpayers with annual revenues up to EUR 25,000 and those who adopt the flat-rate tax regime.

The decree will become effective in 2024, and the taxpayers will also use the Sistema di Interscambio (SdI).

Archiving

Once the electronic invoice has been accepted, it must be archived for at least ten years. All invoices should be stored electronically in an easily accessible format, such as PDF, P7M, or XML.

You may also like: How Many Types of E-Invoice Are There? (In-Depth Analysis)

What should businesses do to comply with e-invoice regulations in Italy?

With the deadline already passed, businesses can still adhere to Italy’s e-invoicing regulations. However, they need to do the following:

Review their current e-invoicing technology

Your system should be able to generate electronic invoices automatically without much effort. Review your existing e-invoicing technology and ensure your accounts receivable and accounts payable systems can incorporate the XML format and include all parties' tax codes.

You can implement advanced systems or updates to generate compliant e-invoices. Reliable access point providers like Storecove can help you submit your electronic invoices if you don’t wish to change your system.

Secure the process

You need to ensure all transactions are secure and legally compliant. Submission of a transaction is only allowed when the invoice is issued through the Sistema di Interscambio (SdI).

Using a secure signing solution will protect your documents from any unauthorized access.

Monitor transactions

You should regularly monitor the status of your invoices and receipt confirmations. This will help you identify any issues once they occur and address them.

Monitoring your transactions also helps you track your taxes to avoid government lawsuits.

Takeaway: Complying with e-invoicing in Italy

The development of e-invoicing in Italy has helped the government reduce tax evasion and fraud. It has also made it easier for businesses to make transactions and file taxes by reducing paperwork and making processes quicker.

Adhering to e-invoicing regulations can be a bit challenging if you don’t have the right software. Generating compliant invoices can be an issue for some businesses, but not to worry.

Storecove is an electronic invoicing service provider that can help you ensure compliance. We help businesses keep up with the evolving e-invoicing regulations in Italy by streamlining processes.

Schedule a demo with our e-invoicing experts today to learn how we can help.

More information about the E-Invoicing Requirements in Italy?

Contact us for more information or schedule a consult with one of our e-invoicing experts.

Read also:

Comments